Loudoun County’s Budget Cycle

The Loudoun County budget year runs from July 1 to June 30. The County is currently operating under the FY-2026 budget, and the process for formulating the FY-2027 budget is already underway. This process is overseen by the County Administrator.

How the Budget Is Formulated

The annual budget process unfolds as follows:

- September–October: County staff develop preliminary revenue estimates.

- November–December: County departments submit budget requests, which are compiled into a proposed budget.

- Late January/Early February: The County Administrator presents the proposed budget to the Board of Supervisors (BOS).

- February–March: The BOS conducts work sessions and holds at least two public meetings.

The goal is to adopt the budget by April 15. For FY-2026, the budget was formally adopted on April 1, 2025.

The Cost to Taxpayers

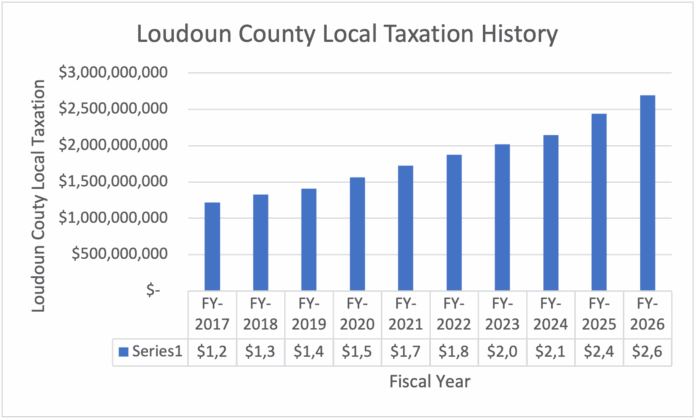

How does this process affect Loudoun County taxpayers? In short—poorly. From 2017 to 2026, the budgeting process resulted in a 121% increase in local taxation.

Some may point to inflation and population growth, but that explanation does not hold. The combined effect of both is roughly half the magnitude of the tax increase.

For example:

- The FY-2026 budget increased local taxation by 11% over FY-2025.

- FY-2025 increased local taxation by 13.7% over FY-2024.

This represents a 26% increase in taxation over just two years, during a period of moderate inflation (around 3%) and no population growth. The only reasonable explanation for these increases is excessive spending.

Problems in the Budgeting Process

Several issues undermine transparency and public participation:

Opaque Early Stages

The beginning of the process is almost entirely hidden from public view. Little to nothing is reported in the news, and any initial guidance the BOS provides to the County Administrator is not made public.

Late Release of the Proposed Budget

The proposed budget is released very late. For FY-2026, the document was not available to the public until February 12, 2025, even though much of it was essentially finalized by that point.

Limited Public Input

Public hearings are announced with minimal notice. For FY-2026, the public input session (Feb. 22) and the public hearing (Feb. 27) were both announced on Feb. 12.

The hearings themselves provide little opportunity for meaningful participation. In 2025, each speaker was limited to three minutes. At the 6:00 PM session, only part of the Board was present—including the absence of the Board Chair. There was only one speaker calling for restraint; others largely advocated for more spending.

Rushed Final Adoption

The FY-2026 budget was approved on April 1—barely a month after the hearings. A five-month process, followed by finalization within weeks of public release, suggests the system is structured to minimize public influence.

Recommendations for Reform

Several changes could meaningfully improve the process:

- Public BOS Budget Guidance:

The BOS should publicly establish and publish budget guidance at the start of the process. This would give residents early insight into the direction of the budget. - Public Hearings on the Guidance:

Hearings should be held on the guidance itself since it largely determines the eventual outcome. - Earlier Release of the Proposed Budget:

The proposed budget should be made available by December, giving the public ample time to review and comment.

While these steps would increase transparency and public involvement, only a Board of Supervisors committed to limiting government growth can truly restrain spending. Without such leadership, Loudoun County risks becoming increasingly unaffordable.

Taxpayers beware.

NEWSLETTER SIGNUP

Subscribe to our newsletter! Get updates on all the latest news in Virginia.